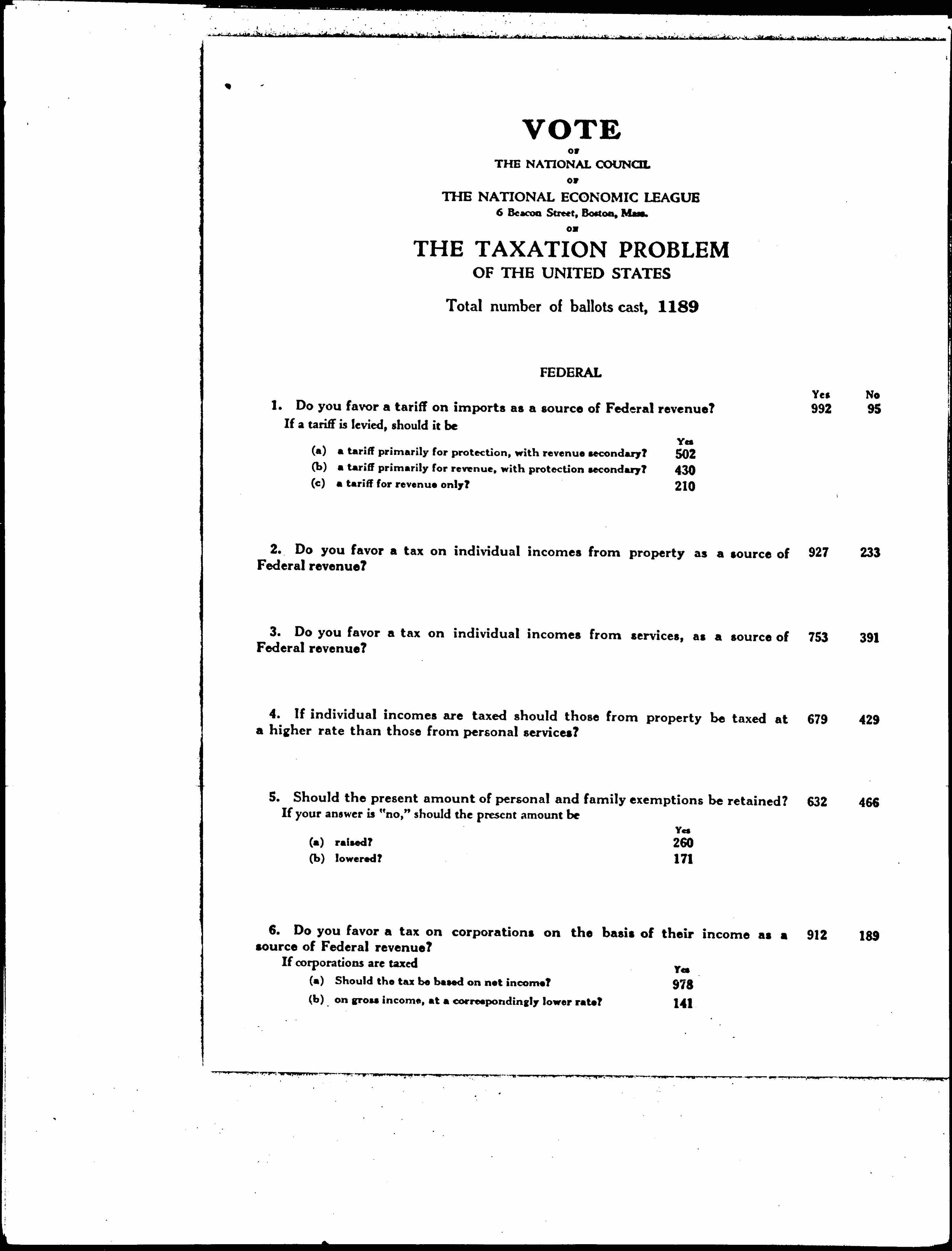

VOTE

OF THE NATIONAL ECONOMIC COUNCIL of THE NATIONAL ECONOMIC LEAGUE

6, Beacon Street Boston, Mass.

ON THE TAXATION PROBLEM OF THE UNITED STATES

Total number of ballots cast, 1189

| FEDERAL | ||||

| 1. Do you favor a tariff on imports as a source of Federal revenue? | Yes 992 |

No 95 |

||

| If a tariff is levied, should it be | Yes | |||

| (a) a tariff primarily for protection, with revenue secondary? | 502 | |||

| (b) a tariff primarily for revenue, with protection secondary? | 430 | |||

| (c) a tariff for revenue only? | 210 | |||

| 2. Do you favor a tax on individual income from property as a source of Federal revenue? | 927 | 233 | ||

| 3. Do you favor a tax on individual incomes from services, as a source of Federal revenue? | 753 | 391 | ||

| 4. If individual incomes are taxed should those from property be taxed at a higher rate than those from personal services? | 679 | 429 | ||

| 5. Should the present amount of personal and family exemptions be retained? | 632 | 466 | ||

| If your answer is "no," should the present amount be | Yes | |||

| (a) raised? | 260 | |||

| (b) lowered? | 171 | |||

| 6. Do you favor a tax on corporations on the basis of their income as a source of Federal revenue? | 912 | 189 | ||

| If corporations are taxed | Yes | |||

| (a) Should the tax be based on net income? | 978 | |||

| (b) on gross income, at a correspondingly lower rate? | 141 [page 2] |

|||

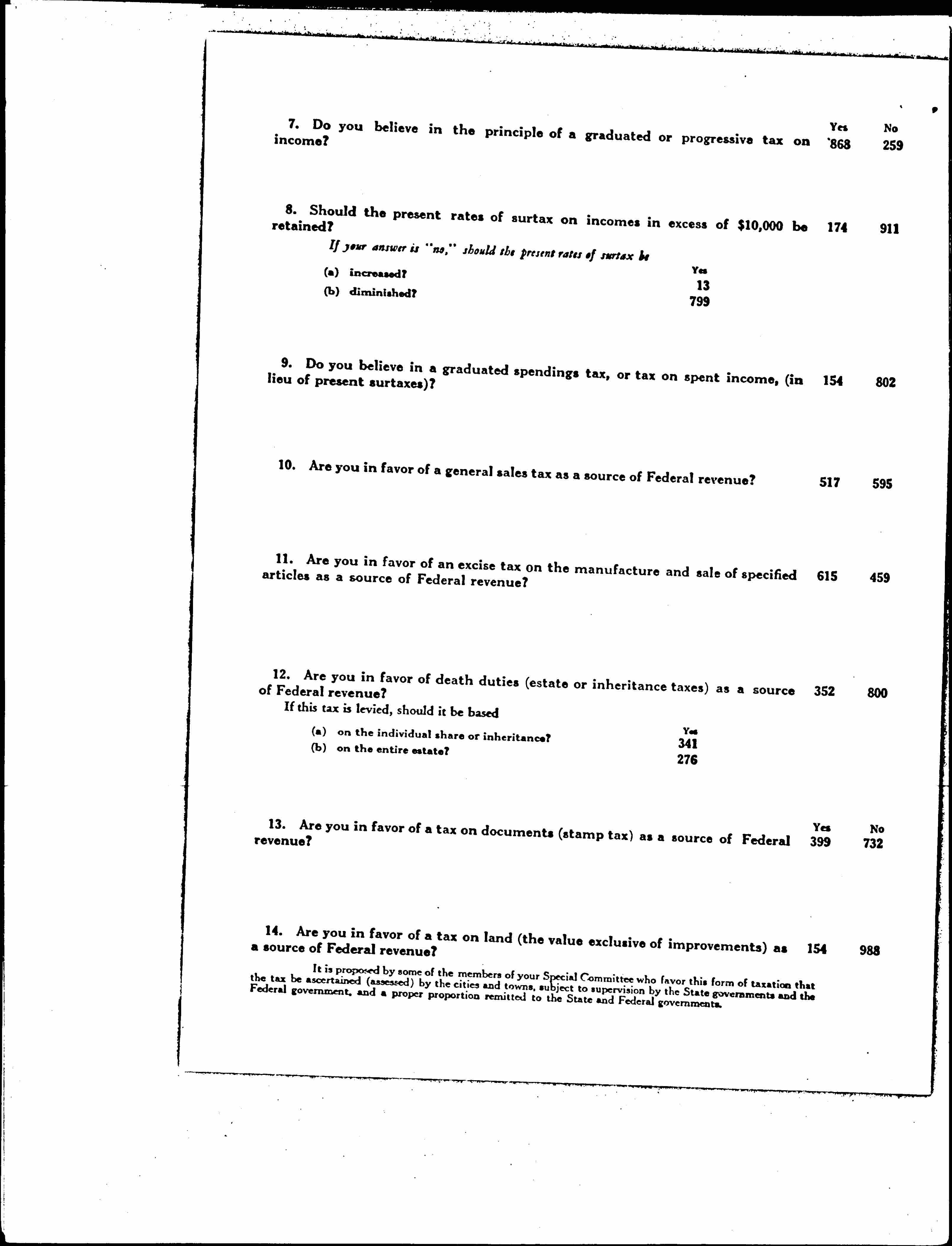

| 7. Do you believe in the principle of a graduated or progressive tax on income? | Yes 868 |

No 259 |

||

| 8. Should the present rates of surtax on incomes in excess of $10,000 be retained? | 174 | 911 | ||

| If your answer is "no," should the present be | Yes | |||

| (a) increased? | 13 | |||

| (b) diminished? | 799 | |||

| 9. Do you believe in a graduated spendings tax, or tax on spent income, (in lieu of present surtaxes)? | 154 | 802 | ||

| 10. Are you in favor of a general sales tax as a source of Federal revenue? | 517 | 595 | ||

| 11. Are you in favor of an excise tax on the manufacture and sale of specified articles as a source of Federal revenue? | 615 | 459 | ||

| 12. Are you in favor of death duties (estate or inheritance taxes) as a source of Federal revenue? | 352 | 800 | ||

| If this tax is levied, should it be based | Yes | |||

| (a) on the individual share or inheritance? | 341 | |||

| (b) on the entire estate? | 276 | |||

| 13. Are you in favor of a tax on documents (stamp tax) as a source of Federal revenue? | 399 | 732 | ||

| 14. Are you in favor of a tax on land (the value exclusive of improvements) as a source of Federal revenue? | 154 | 988 | ||

| It is proposed by some of the members of your Special Committee who favor this form of taxation that the tax be ascertained (assessed) by the cities and towns, subject to supervision by the State governments and the Federal government, and a proper proportion remitted to the State and Federal governments. [page 3] | ||||

| 15. Should the income tax be reserved solely as a source of revenue for the Federal government? | Yes 775 |

No 353 |

||

| 16. Should the income tax be reserved solely as a source of state and local revenue, (i.e., for the States and their political subdivisions)? | 100 | 926 | ||

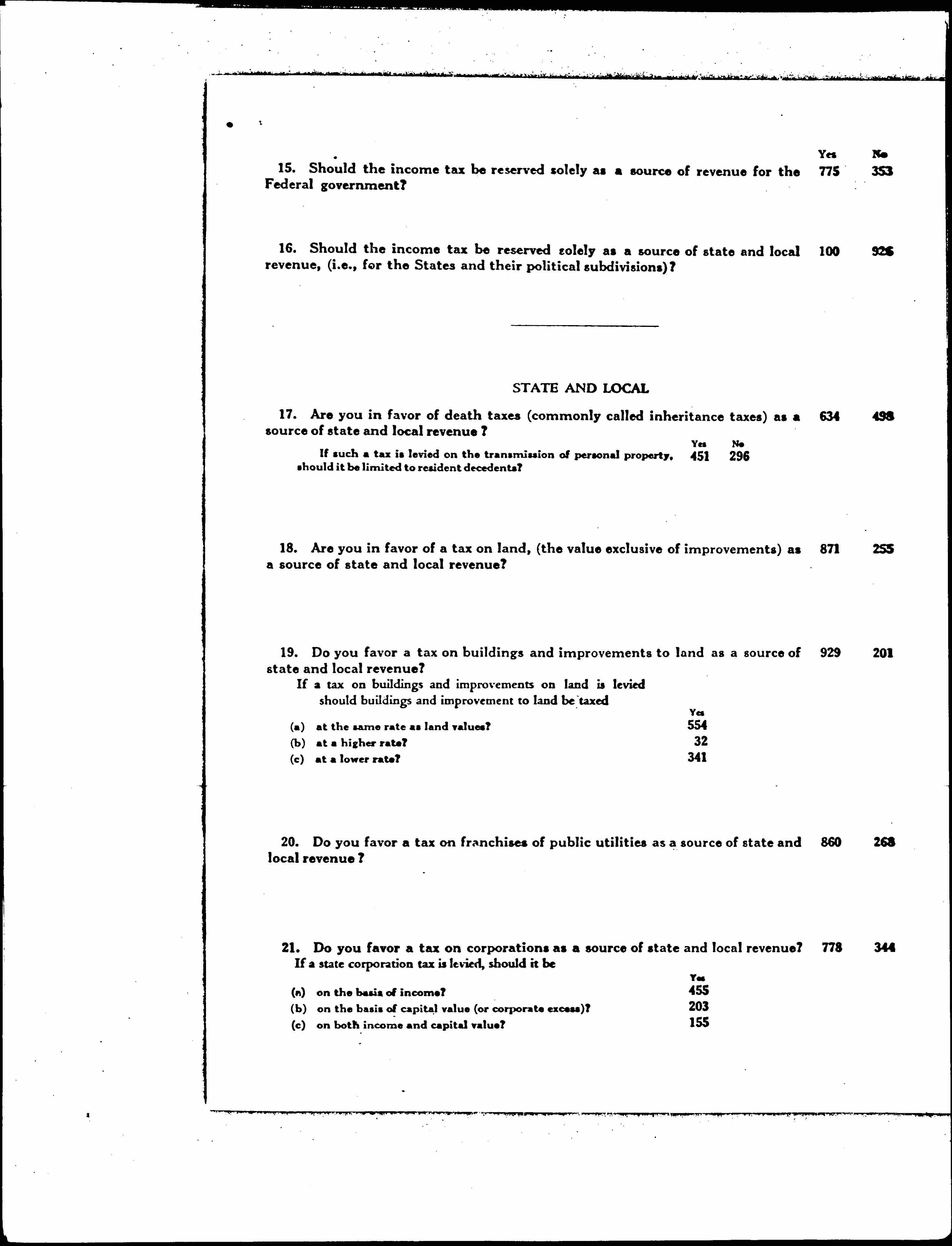

| STATE AND LOCAL | ||||

| 17. Are you in favor of death taxes (commonly called inheritance taxes) as a source of state and local revenue? | 634 | 498 | ||

| If such a tax is levied on the transmission of personal property, should it be limited to resident decedents? | Yes 451 |

No 296 |

||

| 18. Are you in favor of a tax on land, (the value exclusive of improvements) as a source of state and local revenue? | 871 | 255 | ||

| 19. Do you favor a tax on buildings and improvements to land as a source of state and local revenue? | 929 | 201 | ||

| If a tax on buildings and improvements on land is levied should buildings and improvement to land be taxed | Yes | |||

| (a) at the same rate as land values? | 554 | |||

| (b) at a higher rate? | 32 | |||

| (c) at a lower rate? | 341 | |||

| 20. Do you favor a tax on franchises of public utilities as a source of state and local revenue? | 860 | 268 | ||

| 21. Do you favor a tax on corporations as a source of state and local revenue? | 778 | 344 | ||

| If a state corporation tax is levied, should it be | Yes | |||

| (a) on the basis of income? | 455 | |||

| (b) on the basis of capital value (or corporate excess)? | 203 | |||

| (c) on both income and capital value? | 155 [page 4] |

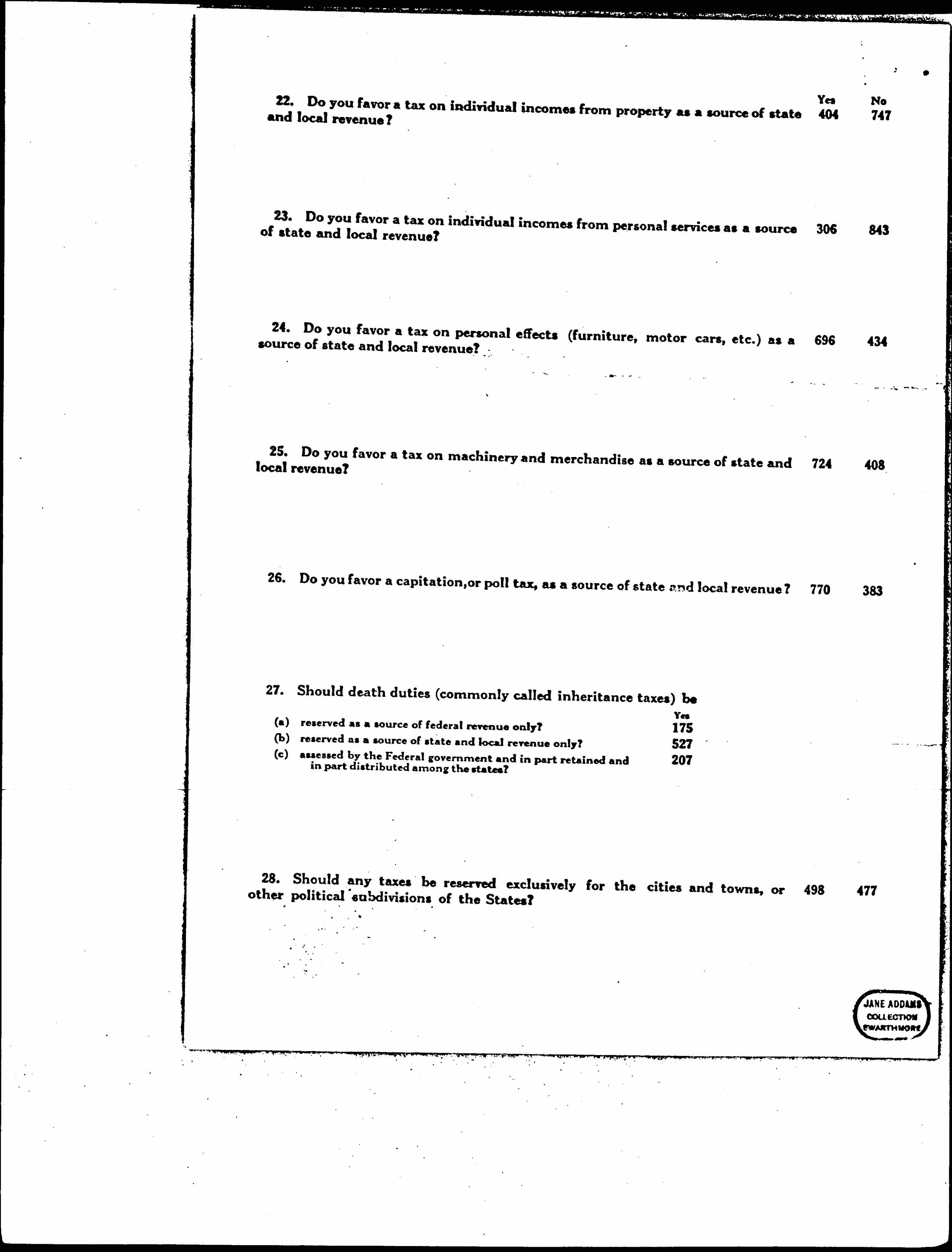

|||

| 22. Do you favor a tax on individual incomes from property as a source of state and local revenue? | Yes 404 |

No 747 |

||

| 23. Do you favor a tax on individual incomes from personal services as a source of state and local revenue? | 306 | 843 | ||

| 24. Do you favor a tax on personal effects (furniture, motor cars, etc.) as a source of state and local revenue? | 696 | 434 | ||

| 25. Do you favor a tax on machinery and merchandise as a source of state and local revenue? | 724 | 408 | ||

| 26. Do you favor a capitation, or poll tax, as a source of state and local revenue? | 770 | 383 | ||

| 27. Should death duties (commonly called inheritance taxes) be | Yes | |||

| (a) reserved as a source of federal revenue only? | 175 | |||

| (b) reserved as a source of state and local revenue only? | 527 | |||

| (c) assessed by the Federal government and in part retained and in part distributed among the states? | 207 | |||

| 28. Should any taxes be reserved exclusively for the cities and towns, or other political subdivisions of the States? | 498 | 477 |

Comments